You can avoid any fraudulent activities and stop further damage to your financial account. Preparing your income statement from time to time gives you an opportunity to raise any questions in case that you find errors in it. We cannot help but be careful with how we spend our money so what we do is keep watch of our finances. Since bank statements contain your financial transactions, you will be able to identify and evaluate if there are any errors or mistakes in it. Monthly Bank Statementĭownload What Is the Importance of a Bank Statement?Ī bank statement is important for a person or an entity who owns a financial account from any institution who provides it like the bank. You can either go to your nearest branch or call their customer care hotline and ask for some clarifications and explanations of such occurrences. However, when these problems occur, the best thing to do is to contact your bank.

It buys the food we eat, gets us to transport from one place to another, and get the things that could make us happy. Money is an important factor in our day-to-day activities. We could understand why such behaviors could be observed. Some even become too emotional upon seeing unfamiliar transactions. There are times when we cannot avoid but wonder and ask some of the items or transactions written on our bank opening statements.

What Are the Steps Necessary to Reconcile a Bank Statement?

However, due to emergence of new technologies, bank statements have evolved to become paperless which are now sent through emails and other digital methods of sending them. Some people still choose this method so they can literally check and see what activities have been made through their bank accounts.

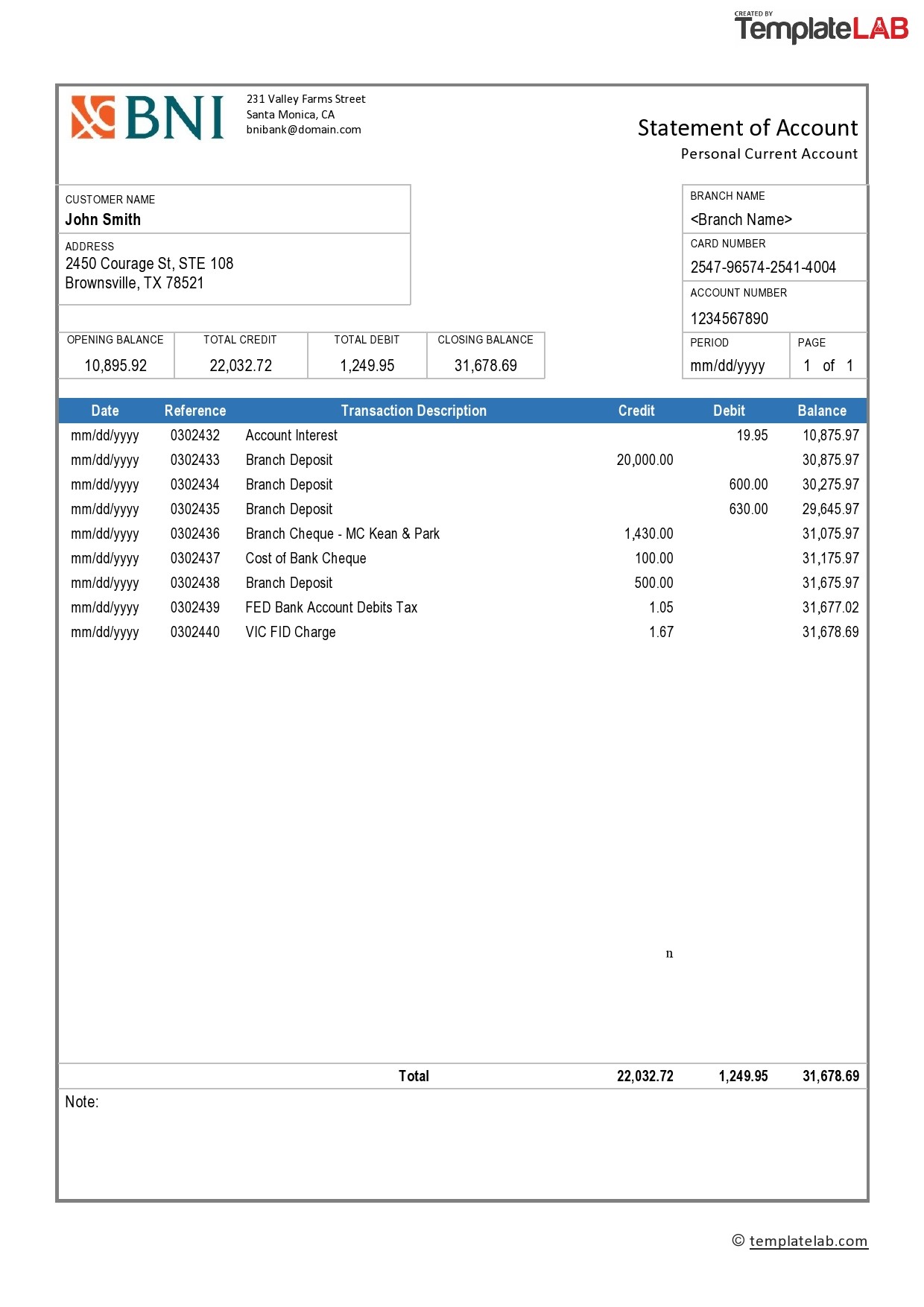

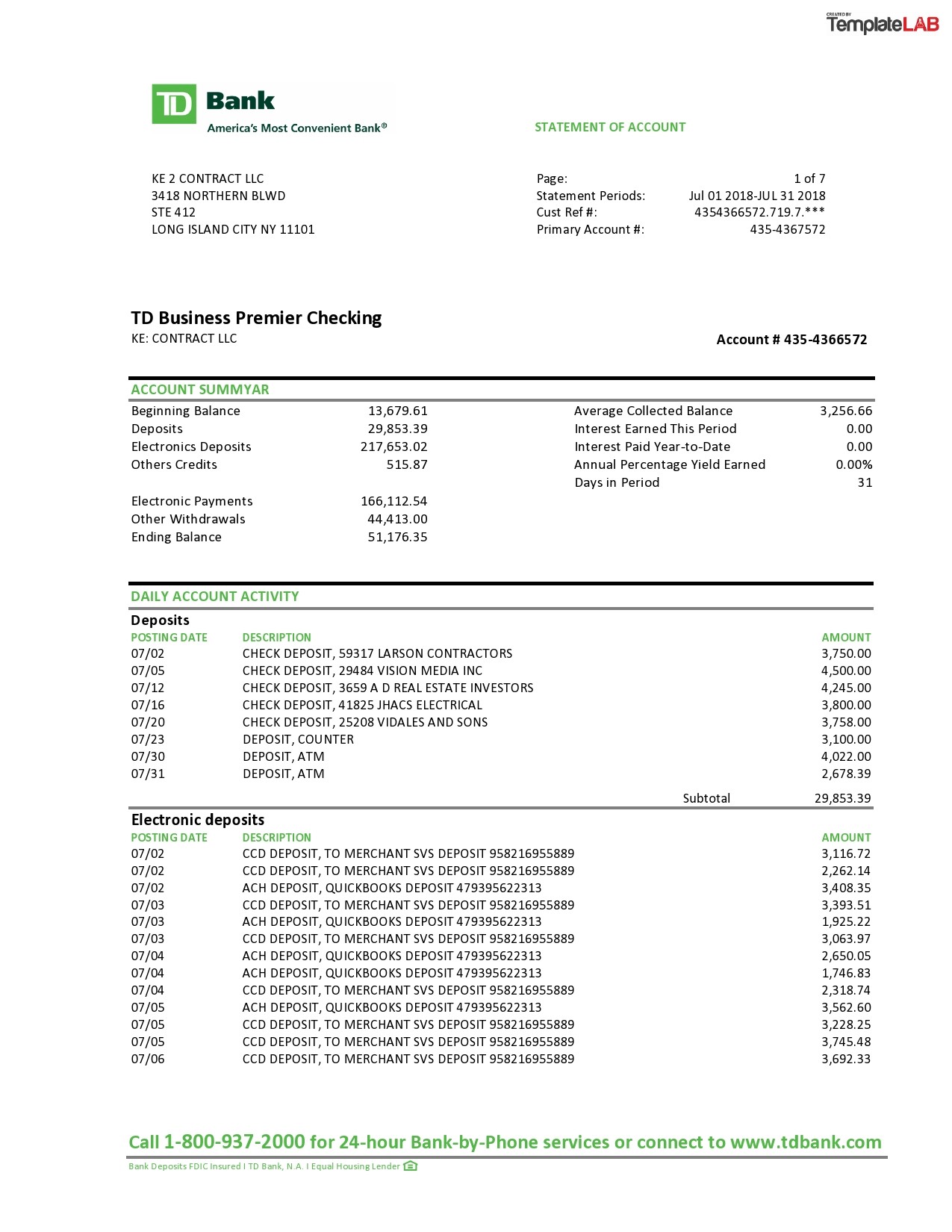

Bank statements are typically sent through mail in its traditionally paper format. It consists of transactions like debit and credit, withdrawals, and deposits. A bank statement is defined by Wikipedia as “a summary of financial transactions which have occurred over a given period on a bank account held by a person or business statement with a financial institution.”

0 kommentar(er)

0 kommentar(er)